“立即购买”的兴起, “晚点付款”(BNPL)服务颠覆了传统的贷款格局, 为消费者提供一种新的购买融资方式. 随着它继续获得牵引力, it’s crucial for consumers and businesses to understand the intricacies of this alternative financing model.

我们将深入研究BNPL的利弊, shedding light on its benefits and potential pitfalls and give you some advice on choosing a BNPL provider that suits your needs.

本文是与我们的合作伙伴, Sileon. Our partnership started in May 2023 and become an exciting development that drives innovation and shapes the fintech landscape with more cutting-edge solutions.

这种合作关系结合了金奇克的深厚 金融科技软件开发专业知识 Sileon可扩展的BNPL软件产品,包括平台和解决方案模块. 而Sileon的平台则是BNPL的核心银行系统, the Solution modules are elective components that can be placed on top of the Platform for an additional tailored BNPL offering.

金迪克的核心经营理念是以客户为中心. This partnership with Sileon further strengthens Kindgeek’s commitment to delivering tailored solutions for financial institutions and their customers’ unique needs. 我们的综合专业知识可以缩短产品上市时间.

它还允许我们为本文提供更深入、更复杂的见解. 继续往下读.

什么是BNPL,它是如何工作的?

BNPL stands for Buy Now Pay Later and is a type of short-term financing that allows consumers to make purchases and pay for them in instalments over a period of time, 通常是几周或几个月, 而不是预先支付全部金额. 它变得越来越受欢迎,一些最大的零售商和应用程序,如 贝宝,提供这项服务.

当你在网上结账时,你会经常看到BNPL付款计划. 店内购物, 供应商通常提供虚拟卡,可以从供应商的移动应用程序下载, 保存到移动钱包,在收银台使用.

那么它是如何工作的呢? 让我们从客户的角度来看典型的流程:

- 在结账时,无论是在网上还是在店内,消费者都可以选择使用BNPL付款.

- 然后, 他们通常需要填写一份简短的申请表, 提供诸如姓名之类的信息, address, 电子邮件地址, 出生日期, 电话号码, 和社会安全号码.

- 购买金额分成等额分期付款, 通常是四个或更少, 首期付款在购买时支付.

- The remaining instalments are automatically charged to the consumer’s debit or credit card on a schedule, 通常每两周或每月一次.

- 许多BNPL供应商不收取利息或按时付款的费用. 但是,如果错过或延迟付款,可能会产生滞纳金或延期利息.

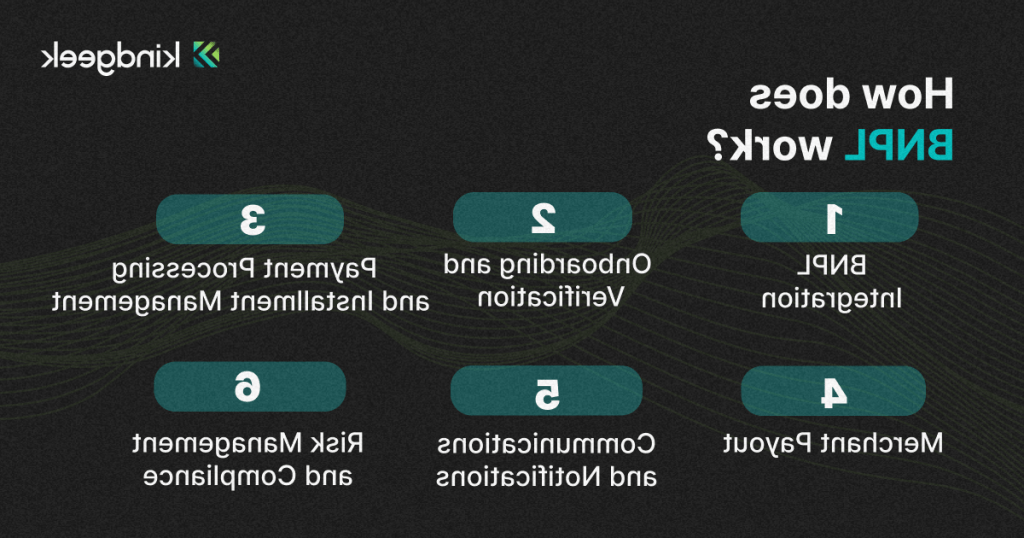

为了让这个过程对客户来说简单易行, 银行卡提供商, 商人, 和BNPL供应商确保一些额外的和必要的步骤:

BNPL集成

BNPL providers offer APIs (Application Programming Interfaces) or software development kits (SDKs) that allow 银行卡提供商 and 商人 to integrate BNPL payment options. These integrations enable customers to select the BNPL option during the checkout process and provide the necessary information.

客户入职和验证

当客户选择现在购买以后支付选项, 提供商的平台收集并验证其个人和财务信息, 比如名字, 电子邮件, 电话号码, 以及借记卡或信用卡的详细信息. Soft credit checks or alternative data sources may be used to assess creditworthiness and fraud risk.

付款处理和分期付款管理

The BNPL provider processes the initial down payment and captures the customer’s payment method for future instalments. 该平台管理分期付款时间表, automatically charging the customer’s payment method on the predetermined dates for the remaining instalments.

商人支付

BNPL供应商通常会提前向商家支付总购买金额, 减去任何费用或佣金. 这可以确保商家立即收到付款, 而BNPL供应商则负责向客户收取分期付款.

客户沟通及通知

BNPL平台通常有强大的通信系统来发送付款提醒, 分期付款截止日期通知, 和其他客户通过电子邮件更新, 短信, 或者应用内通知. Some providers offer customer portals or mobile apps where customers can manage their BNPL orders, 查看付款时间表, 更新支付方式.

风险管理和法规遵从性

BNPL供应商利用数据分析和机器学习算法来评估风险, 检测欺诈行为, 在向客户提供信贷方面做出明智的决定. 他们可能会使用客户数据, 购买历史, 以及外部资源来完善他们的风险模型并改善整体客户体验.

他们还必须遵守与消费贷款有关的各种规定, 数据隐私, 金融服务业, 这在不同的司法管辖区可能有所不同. 他们的平台设计符合相关法律和行业标准.

将BNPL添加到您的卡的5个理由(由Sileon提供)

作为一个银行卡提供商, 整合现在购买, Pay Later (BNPL) solutions into your credit and debit card offerings can be highly beneficial for both you and the end user. Here are several compelling reasons why choosing BNPL as an option can enhance the overall experience:

增加收入和盈利能力

Integrating BNPL options can significantly increase the profitability of your debit and credit cards. 它开辟了新的收入来源,提高了持卡人的整体价值主张.

使你的卡片现代化,吸引新客户

BNPL integration helps exceed your existing cardholders’ digital expectations and attracts new customers looking for convenient payment options. 它使您的卡产品现代化,并与当前的市场趋势保持一致.

BNPL SaaS没有技术障碍

You can easily integrate BNPL solutions into your existing card infrastructure with BNPL Software as a Service (SaaS). 这种即插即用的方法最大限度地减少了技术障碍,并加速了实施.

绕过结帐和POS的复杂性

BNPL allows you to reach customers seamlessly without relying on complex checkout or point-of-sale (POS) infrastructure. 这种简化的流程提高了客户的便利性和满意度.

负责任的BNPL实践

Offering BNPL through your cards enables a sustainable BNPL model with responsible lending practices. 这在持卡人之间建立了信任,促进了长期的财务健康.

将BNPL选项集成到您的卡产品中符合消费者趋势, 促进普惠金融, 并加强你们在市场上的竞争地位. It’s a strategic move that not only benefits end users with enhanced payment flexibility but also drives business growth and customer engagement for the bank.

与BNPL相关的风险以及如何减轻风险

尽管在信用卡上澳门十大正规赌博娱乐平台现在买以后付的服务有很多好处, 提供商必须意识到潜在的风险,并实施适当的实践来减轻风险. 例如,去年,美国货币监理署(OCC) 提供了指导 十大网博靠谱平台管理与BNPL贷款相关的风险.S. 它包含以下风险列表:

- 缺乏明确的, 标准化的披露语言可能会掩盖贷款的真实性质, 对消费者造成伤害, 否则会有违反禁令的风险, 具有欺骗性的, 或虐待行为或行为.

- BNPL贷款的高度自动化性质, 即时的信贷决策和频繁的对第三方的坚定依赖, 会增加操作风险, 包括欺诈导致的首次付款违约风险升高.

- 贷款人可能缺乏有关申请人BNPL借款活动的全面信息, 因为信用报告机构通常对BNPL贷款数据的获取有限. This incomplete reporting can make it challenging for 银行 to assess an applicant’s total debt obligations and financial commitments before approving new credit lines.

为了减轻这些风险,OCC建议采取以下措施:

信用风险管理

建议银行采用收集BNPL债务的方法, 减轻损失, and contact borrowers may require specialised approaches and strategies that differ from traditional consumer debt collection practices. 十大网博靠谱平台冲销做法, banks are advised to appropriately tailor their charge-off policies for the short-term nature of BNPL loans.

操作风险管理

Banks are advised to establish: internal controls and processes for handling merchandise returns and merchant disputes; processes to confirm that potential borrowers are of legal age to obtain credit; procedures to address first payment default; controls to identify suspected fraud in a timely manner; and risk models.

第三方风险管理

管理与BNPL贷款有关的第三方关系所产生的风险, 比如与商家的关系, 是必须的.

合规风险管理

Bank management is advised to consider the applicability of consumer protection-related laws and regulations to the bank’s specific BNPL products, 特别是在产品交付方式方面, 市场营销, 广告, 以及其他标准化的信息披露. They should also consider billing dispute and error resolution rights and practices relating to automatic payments, 多重支付表示, 还有滞纳金. BNPL贷款应当纳入银行合规管理体系.

和其他行业一样, 意识到风险并采取措施减轻风险对企业的运营至关重要. 在金融服务行业尤其如此, 客户和服务提供商的安全是第一位的.

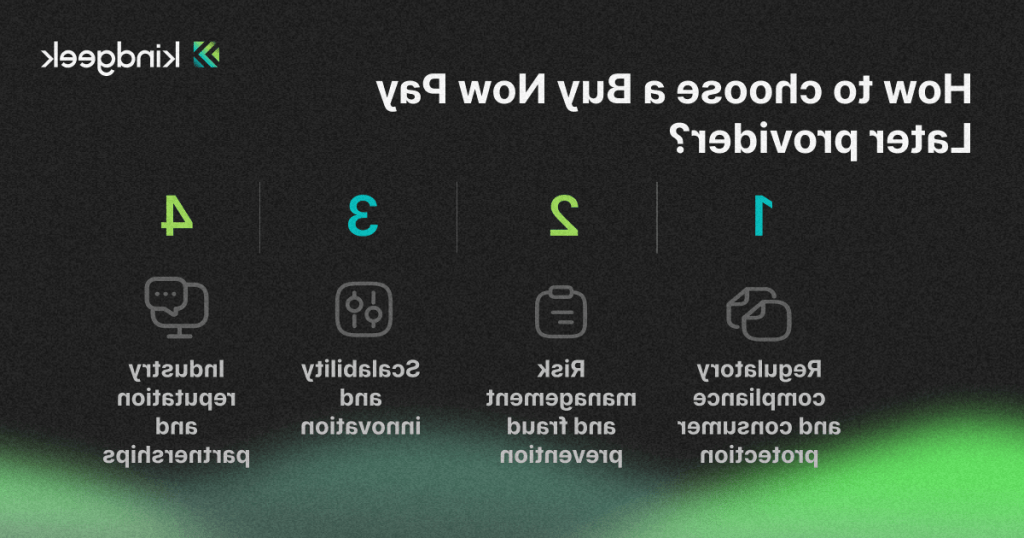

如何选择先买后付的供应商?

Choosing the right Buy Now Pay Later provider is a critical decision that requires careful consideration of various factors:

法规遵从性和消费者保护

当你为你的业务引入第三方服务提供商时, 确保他们牢记客户的最佳利益应该是优先考虑的. BNPL供应商应遵守相关的消费者保护法律法规. 他们应该优先考虑数据隐私, 公平借贷实务, 负责任的贷款原则, 培育信任,维护消费者利益.

风险管理和欺诈预防

BNPL提供商可以访问您客户最敏感的信息, including payment methods and other identifying information required to process their approval check. 这意味着他们应该有强有力的策略来发现和防止各种形式的欺诈, 包括身份盗窃, 账户收购, 以及合成欺诈. Their ability to handle data breaches and protect customer information is a testament to their commitment to security.

可扩展性和创新

随着BNPL市场的持续增长, 提供商必须能够扩展和处理不断增加的交易量和客户增长. 他们在技术上的投资, 数据分析, and product innovation is crucial to staying ahead of evolving market trends and consumer preferences.

行业声誉和合作伙伴关系

研究供应商在行业中的地位以及他们与商家的关系, 银行, 消费者权益保护组织, 行业协会, 监管机构, 以及其他利益相关者. 供应商优先考虑透明度, 道德实践, 负责任的贷款更有可能培养信任,保持良好的声誉.

通过彻底评估这些因素并采取整体方法, you can make an informed decision when choosing a BNPL provider that aligns with your business values, 优先保护消费者, 并提供了一个安全的, 透明的, 负责任的贷款经验.

结论

随着BNPL行业不断发展并获得主流采用, 很明显,这种替代融资模式既带来了机遇,也带来了挑战. 企业必须根据法规遵从性等因素仔细评估BNPL提供商, 消费者保障措施, 风险管理策略, 以及整体声誉. Partnering with a reputable and responsible BNPL provider is essential to ensure a positive customer experience.

在不断变化的金融服务领域, BNPL代表了我们如何看待和处理消费贷款的重大转变. 就像任何颠覆性创新一样, 以深思熟虑和见多识广的心态来对待BNPL是至关重要的, 利用它的好处,同时意识到它的潜在缺陷.